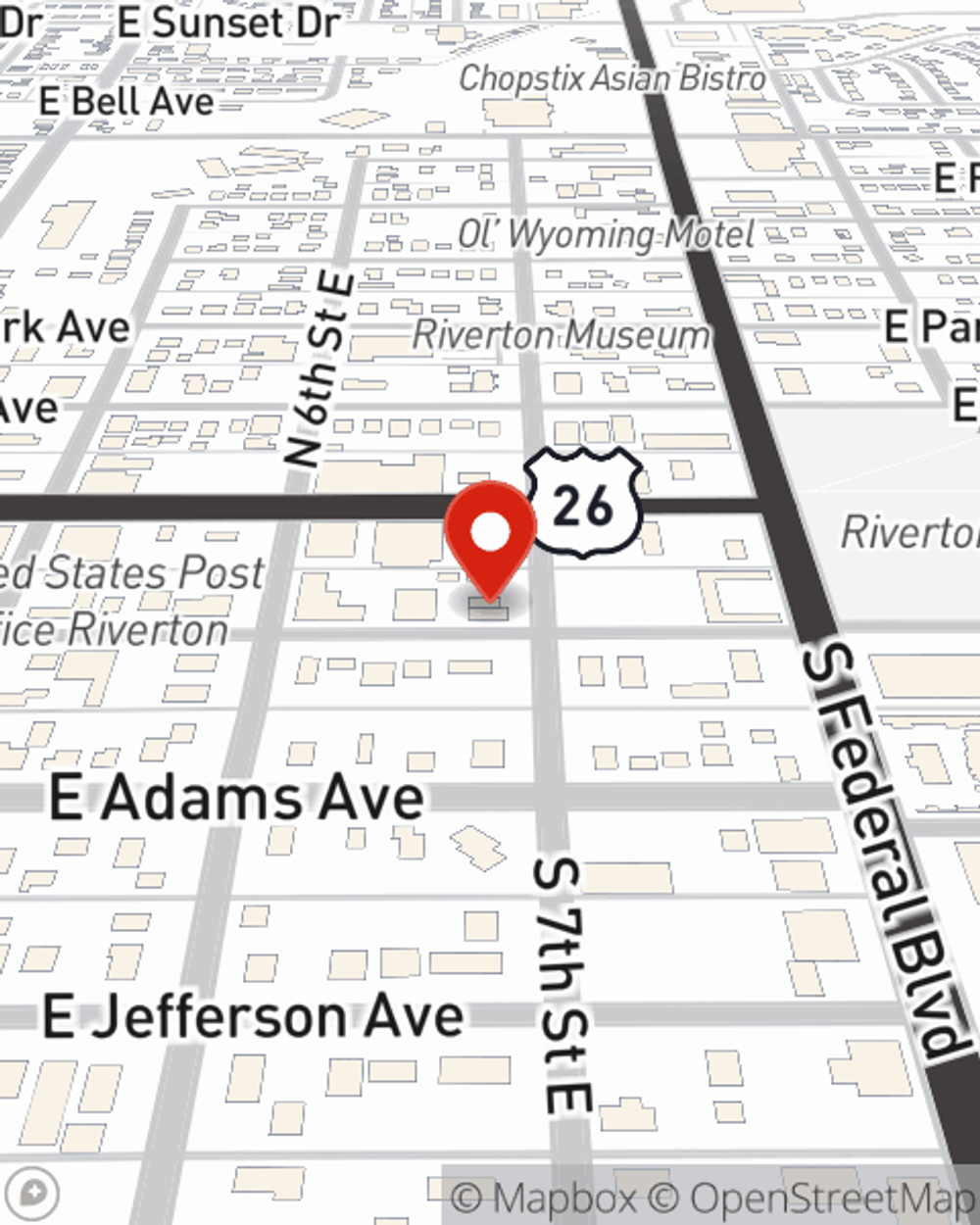

Business Insurance in and around Riverton

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

Operating your small business takes time, hard work, and terrific insurance. That's why State Farm offers coverage options like errors and omissions liability, business continuity plans, extra liability coverage, and more!

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

Your company is one of a kind. It's where you make your living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a facility or earning a paycheck. Your business is part of who you are. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a wide range of occupations like a barber. State Farm agent Tyler Watson is ready to help review coverages that fit your business needs. Whether you are a landlord, a pharmacist or a fence contractor, or your business is a meat or seafood market, a fabric store or a music school. Whatever your do, your State Farm agent can help because our agents are business owners too! Tyler Watson understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Get right down to business by reaching out to agent Tyler Watson's team to talk through your options.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Tyler Watson

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.